How to find out if weight loss drugs are covered by your insurance, and what to do if they're not

How to find out if weight loss drugs are covered by your insurance, and what to do if they're not

(semaglutide), (liraglutide), and (semaglutide) are popular medications used to treat Type 2 diabetes or help with . They belong to a class called glucagon-like peptide-1 (GLP-1) receptor agonists. (tirzepatide) and (tirzepatide) are also common treatments in a class known as .

Some , like Zepbound, Wegovy, and (liraglutide), are . Others, such as Ozempic and Victoza, are sometimes prescribed for weight loss.

Insurance coverage for GLP-1 agonists when used for weight loss varies widely, explains , a platform for medication savings. But these medications are often covered when prescribed for their other FDA-approved uses. Examples include or cardiovascular risk reduction. If you’re considering treatment with GLP-1 agonists, review your plan’s policies. There are several ways to improve your chances of insurance approval.

Note: In this article, the terms “GLP-1 agonists” and “GLP-1 medications” include Zepbound and Mounjaro. This is for ease of reading. But Zepbound and Mounjaro belong to a different medication class. They work similarly to GLP-1 agonists.

Key takeaways:

- Glucagon-like peptide-1 (GLP-1) medications such as Ozempic (semaglutide) and Mounjaro (tirzepatide) are commonly covered by insurance when prescribed for Type 2 diabetes, cardiovascular risk reduction, or other FDA-approved indications. These medications are approved to treat Type 2 diabetes. But they have also been shown to support weight loss.

- Insurance coverage for medications taken for weight loss varies. Many plans exclude them from their formulary. But people seeking weight-loss treatment may have an FDA-approved condition, like Type 2 diabetes or heart disease. This can improve their chances of getting coverage.

- To check if a GLP-1 medication is covered, review your plan’s formulary. If your insurance doesn’t cover GLP-1 medications for weight loss, ask a healthcare professional about other approved uses. You can also request an exception and appeal if denied.

How common is GLP-1 insurance coverage?

depends on the condition being treated. Insurance is more likely to cover these medications when they are prescribed for FDA-approved uses. These include managing Type 2 diabetes and reducing cardiovascular risk. Ozempic, for example, is approved to treat Type 2 diabetes. It’s also FDA approved to help reduce the risk of heart attack and stroke in adults with diabetes and heart disease, as well as for adults with diabetes and chronic kidney disease.

About two in three people with Affordable Care Act marketplace plans for brand-name Victoza and the when prescribed for Type 2 diabetes or to reduce heart-related risks in adults with Type 2 diabetes and heart disease. Commercial plans cover brand-name Victoza for two-thirds of members and generic Victoza for three in four members.

Coverage for weight loss alone is less common. It may involve additional requirements or restrictions. In 2024, nearly with 200 or more employees and one in four companies with 5,000 or more employees covered GLP-1 agonists for weight loss. But trends are shifting:

- As of 2025, Kaiser Permanente for weight management to people with a (BMI) of 40 or higher.

- Because of high costs, Blue Cross Blue Shield of Massachusetts plans to for Wegovy, Saxenda, and Zepbound starting in 2026. However, coverage will continue for GLP-1 agonists approved to treat Type 2 diabetes.

Even when GLP-1 agonist medications are covered for weight loss, you may still need to take extra steps. These include:

- Obtaining a (special approval from your insurance company)

- Going through , which involves trying a lower-cost medication first

- Meeting with a dietitian or joining a weight-loss program

Nearly , while about . People considered overweight or obese have a higher chance of developing many conditions. every year. That means many people seeking weight-loss treatment may have a related health condition. This could help them qualify for GLP-1 medication coverage.

How can you check your policy for GLP-1 insurance coverage?

Before starting a GLP-1 medication, it helps to learn about your insurance coverage and requirements. Here’s how to check:

- Log in to your insurance portal. Search the for the GLP-1 medication you’re interested in. If it’s included, review the conditions it’s approved for, the tier it falls under (this affects how much you pay), and your expected .

- Call your insurance company. It’s a good idea to call your insurer to confirm coverage and make sure you’re clear on the requirements. You can ask about restrictions, such as prior authorization or step therapy.

- Contact your employer. If you have employer-sponsored insurance, your human resources department can clarify coverage details. They may also connect you with helpful resources.

- Work with your prescriber. Ask your prescriber’s office to check coverage on your behalf. Many medical offices have electronic tools to verify insurance coverage for medications. Keep in mind that these systems might not show recent coverage changes.

- Use online coverage checker tools. Many GLP-1 manufacturers offer online resources to verify insurance coverage. For example, you can on its website. Saxenda’s manufacturer offers a similar .

- Ask a pharmacist. A pharmacist may be able to run a test claim before filling the prescription. This can check coverage and out-of-pocket costs.

If your plan won’t cover GLP-1 agonists for weight loss, you may have other options. Ask your insurer about coverage for other FDA-approved uses of these medications.

Let’s say you have a health condition like heart disease and meet certain criteria. You might qualify for coverage under that condition instead. A GLP-1 agonist that helps with weight loss might be covered when prescribed for a different approved use.

Does Medicare cover GLP-1 medications?

medications prescribed for weight loss. But it may cover certain GLP-1 agonists if prescribed for another FDA-approved use.

As of 2024, Ozempic, Mounjaro, (semaglutide), and Wegovy for FDA-approved conditions. But they are not covered for weight loss. For example, Ozempic and Mounjaro are FDA-approved to treat Type 2 diabetes. Ozempic is also approved to help reduce the risk of and in adults with diabetes and heart disease, as well as lower the risk of for adults with diabetes and chronic kidney disease. Medicare Part D covers these medications when prescribed for these conditions. Weight loss may occur as a side effect.

Wegovy is FDA-approved. It’s also approved to lower the in adults with heart disease and a larger body size. Medicare Part D covers Wegovy if it’s prescribed for cardiovascular risk reduction. But it’s not covered for weight loss.

Some Medicare beneficiaries can access GLP-1 medications for chronic weight management through . These plans offer added benefits but typically have higher monthly premiums.

How to get insurance to cover GLP-1 medication

It may take some effort to get insurance to cover GLP-1 agonists, especially for chronic weight management. But understanding the steps can improve your chances. Here’s a step-by-step guide:

1. Check insurance coverage

First, verify that your insurance covers the GLP-1 medication you’re interested in. Use the methods discussed above. This will help you understand your coverage and advocate for yourself.

2. Request coverage criteria

Ask your insurer for the coverage criteria or medical necessity guidelines for the GLP-1 medication you want. These documents explain the basis for coverage decisions. They can help you understand which criteria must be met for coverage.

You can call your insurer to request this information. Some plans also make coverage criteria available on their websites.

3. Work with your prescriber

Using the coverage criteria, your prescriber can help ensure you meet the requirements. Together, review your medical history and symptoms. If you don’t qualify for a GLP-1 medication for weight loss, you might qualify for the same or a similar medication for another FDA-approved condition.

If the request for GLP-1 is for weight loss, verify that your BMI measurements are accurate. You may need to show proof of participation in a physician-supervised weight-management program.

For Type 2 diabetes treatment, you’ll likely need to provide proof of your diagnosis. Make sure your (HbA1C or A1C) levels and your diabetes diagnosis are documented in your medical records. Some health plans may ask for documentation of previous medications tried and why you can’t take them.

4. Consider requesting an exception

If you don’t meet your health plan’s criteria for a GLP-1 medication, you may still have options. Your prescriber can write a . This would explain why the medication is appropriate for you. They can submit it with the authorization request.

5. Submit the authorization request

Your prescriber will forward the authorization paperwork and documentation to the insurer. Make sure all requirements are addressed to prevent unnecessary denials and delays.

6. Appeal if denied

If your , you have the right to appeal. Here are the steps to take:

- Review the denial letter to understand the reasons.

- Contact the insurance company for clarification if needed.

- Gather additional information requested.

- Work with your prescriber to .

- Pay attention to deadlines for submitting an appeal.

These steps may increase your chances of getting insurance coverage. Sometimes it takes one or two attempts to get approval, but persistence can pay off.

Why is GLP-1 coverage different for Type 2 diabetes vs. weight management?

When deciding what medications to cover, insurers consider how expenses affect monthly premiums for all plan members. GLP-1 agonists can be costly. Covering them for weight loss could raise premiums for all plan members, even those who don’t use them.

According to a Congressional Budget Office , Medicare would spend $35 billion from 2026 to 2034 if it covered weight-loss medications, including GLP-1 agonists. These medications can save some healthcare expenses (by improving health). But the savings would be smaller than the cost of covering them.

Plus, diabetes treatment is widely viewed as medically necessary. Weight management is often seen as elective. But this view is changing as research shows the . As a result, insurers are much more likely to cover GLP-1 agonists for diabetes than for weight loss.

How much do GLP-1s cost without insurance?

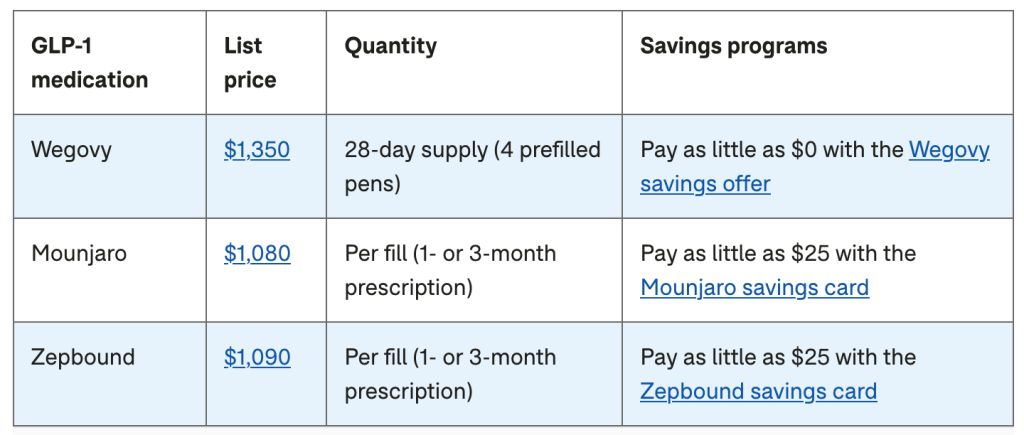

Without insurance or a discount, GLP-1 agonists can cost a few hundred dollars to over $1,000 per month.

The table below shows the list price and available savings cards for a few GLP-1 medications. Keep in mind that retail prices may exceed the list price. This is caused by pharmacy markups, wholesaler fees, and dispensing costs.

What you pay out of pocket can also vary depending on several factors. These include your location and the pharmacy you use.

The bottom line

If you’re seeking insurance coverage for glucagon-like peptide-1 (GLP-1) agonists, review your plan’s medication list. Coverage is more likely when these medications are prescribed for FDA-approved uses, such as Type 2 diabetes or cardiovascular risk reduction, rather than for weight loss alone.

If your plan doesn’t cover GLP-1 agonists for weight loss, ask a healthcare professional whether you may qualify under another approved condition. You can also request a formulary exception or submit an appeal if coverage is denied. There may be restrictions, such as a prior authorization or step therapy. But working with your prescriber and staying persistent can improve your chances of approval.

was produced by and reviewed and distributed by Â鶹Դ´.