SpaceX’s market share in the commercial space launch industry: What investors need to know

SpaceX’s market share in the commercial space launch industry: What investors need to know

Humans have been exploring space since 1957, when the Soviet Union launched Sputnik 1. At the height of the space race, government agencies conducted all space missions, but that’s no longer the case. Private space companies now launch satellites, operate entire “constellations” of privately owned satellites in orbit, shuttle NASA astronauts to and from the International Space Station — and are in the early stages of offering space tourism.

The development of the space industry is exciting from a technological and scientific standpoint. It could also make investors in a lot of money.

How fast is space exploration growing, and which space companies offer the best prospects for investors? shares a detailed look at space launch statistics.

Key Points

- SpaceX leads in orbital space launches, highlighting robust growth in the space sector.

- Space stocks come in many shapes and sizes, some riskier than others.

- Investing in space-focused ETFs like ARKX could diversify exposure to rising space stocks.

How many SpaceX and other rocket launches happen in a year?

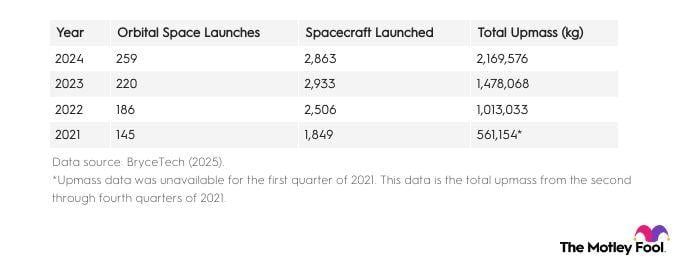

Multiple metrics are used to track space launches. Orbital space launches count spaceflights in which a craft reaches speeds permitting at least one orbit. Spacecraft launches include all vehicles passing either 50 miles’ altitude (the Federal Aviation Administration standard) or the Karman line, the international standard set at 62 miles above Earth’s surface. Total upmass, measured in kilograms, counts the payload carried into orbit on a spaceflight and excludes the mass of the vehicle that carries it.

Orbital space launches have rapidly increased:

- As recently as 2015, orbital space launches in the U.S. rarely reached even double-digits.

- This decade has seen new records set with each passing year. In all of 2014, for example, just 12 rockets were launched from U.S. spaceports — one every 30 days.

- In 2025, a rocket launched — somewhere around the world, and more often than not right here in the U.S. of A. — roughly once every 30 hours.

These launches are carrying more payload, too. Total upmass more than quintupled from 2020 to 2025, reaching 3,020.5 tons. U.S. payloads accounted for 85% of the total, with satellites launched by SpaceX making up the majority of the U.S. payloads.

Who is launching all these rockets, and who is putting all this payload in orbit?

Increasingly, the answer to both questions is: .

Western competing with the privately held () space giant include United Launch Alliance, a joint venture between Boeing and Lockheed Martin, Rocket Lab, and in Europe, Arianespace and its parent company ArianeGroup — both subsidiaries of aerospace giant Airbus.

Here’s how many space launches those companies conducted in 2025:

- Arianespace: 7 space launches in 2025

- ULA: 6

- : 20

- SpaceX: 171

In under two decades, SpaceX has gone from a company on the brink of bankruptcy (in 2008, before the successful orbital launch of its Falcon 1 rocket) to the first to orbit a spacecraft (in 2010, with its Dragon space capsule) to arguably the biggest success story in the space industry.

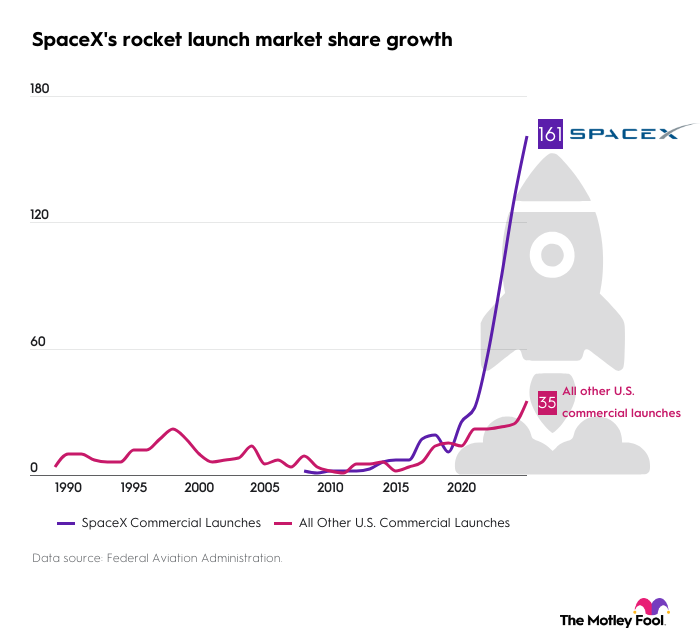

A few SpaceX launch statistics may illustrate their growing market share: In 2014, SpaceX conducted six of the 12 successful U.S. space launches. A year later, it raised $1 billion in funding from early investors Fidelity and Google, began developing Starlink internet satellites, and conducted seven out of America’s nine total launches. In 2017, SpaceX’s global market share reached an impressive 45% of awarded commercial space contracts, making it the top commercial launch provider.

SpaceX’s dominance has continued to grow in the 2020s. It hit new launch records every year from 2020 to 2024, will set yet another record when 2025 wraps up, and is now responsible for roughly 80% of U.S. space launches.

SpaceX’s commercial launch pace and market share capture have been impressive, to say the least:

- 2020: 25 commercial launches, 64% market share

- 2021: 32 commercial launches, 59% market share

- 2022: 57 commercial launches, 72% market share

- 2023: 92 commercial launches, 80% market share

- 2024: 130 commercial launches, 84% market share

- 2025: 161 commercial launches, 82% market share

Space launches by country

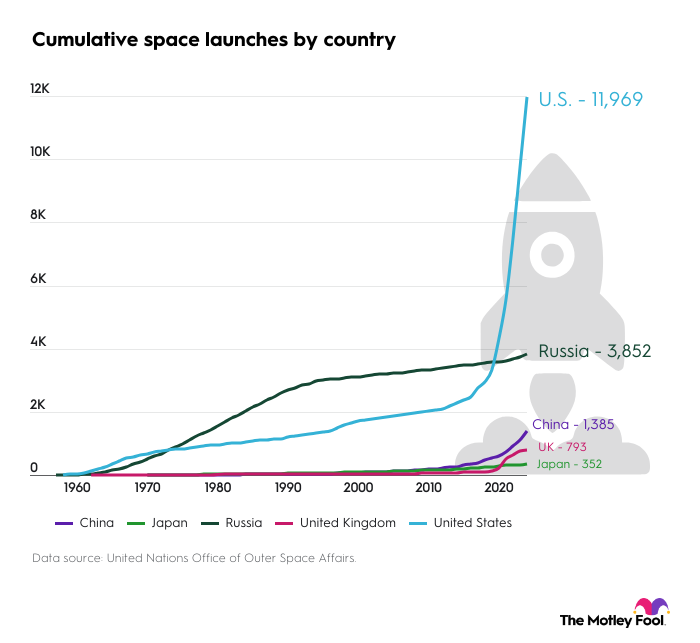

From 1957 until its dissolution in 1991, the USSR conducted 2,760 space launches, more than twice as many as the U.S. (1,221). Despite what the space launch numbers suggest, however, the United States clearly had the more successful space program, winning the race to land humans on the moon, and developing and flying reusable space shuttles 135 times. (The Soviets also developed a shuttle, the Buran, but it flew only once — uncrewed — in 1988).

In more recent years, and especially since the start of the Ukraine war, Russian launches have slowed considerably. It has ceded its second-place position in space to China, where launches are accelerating. Still, the U.S. remains far and away the leader in space exploration, launching 7,605 times from 2010 through 2023, versus 3,277 times for the rest of the world combined.

Why commercial space launches matter for investors

The increasing number of commercial space launches and the upward trend in upmass serve as unmistakable signs of space industry growth. Space is a high-risk, high-reward industry, however. Space launches are expensive, and space companies often operate at a loss for years while developing their businesses.

Luckily for investors, in the West at least, publicly traded space stocks such as Boeing, Lockheed, , and — maybe soon — SpaceX continue to blaze the way to U.S. dominance in space.

Investors also benefit from the fact that many space names are fairly well-known and high-profile. It’s easy to identify potential prospects with names as famed as and, for example, both well-known defense contractors, and also space stalwarts. SpaceX, if it goes public, will be just as easy.

Second-tier space players — if not exactly second-tier companies — include such as Northrop Grumman and L3Harris Technologies. Rocket Lab, too, probably belongs in this grouping — although one could argue Rocket Lab is moving up in visibility, while Northrop and L3Harris are perhaps becoming lower-profile.

Things get a bit more complicated as you enter the realm of "newspace" companies, space start-ups with names like AST SpaceMobile, BlackSky, Firefly Aerospace, and Planet Labs. Smaller in market capitalization and largely unprofitable, these are the kind of “get in on the ground floor” space companies offering the most potential for profit — and also the biggest risk of going broke.

Those who want to invest in a broad swath of space stocks, to and by owning both established space companies and a smattering of start-ups, might consider investing in space-focused exchange-traded funds (ETFs) instead. The is probably the best-known ETF in this camp.

Instant diversification and exposure to a brand new industry in space? It’s hard to argue with that.

was produced by and reviewed and distributed by Â鶹Դ´.