Valuations in 2026: Why todayŌĆÖs 'expensive' market might not be as risky as it seems

Valuations in 2026: Why todayŌĆÖs ŌĆśexpensiveŌĆÖ market might not be as risky as it seems

One of the biggest investor concerns entering 2026 is that markets seem ŌĆ£too expensiveŌĆØ to keep climbing. ItŌĆÖs true that the S&P 500ŌĆÖs valuation is high relative to historyŌĆönot far from levels that preceded the dot-com bubble.

But comparing todayŌĆÖs price-to-earnings ratio to historical averages is too simplistic. Added context reveals a market thatŌĆÖs elevated but not nearly as extended as the late 1990s. explains why the comparison falls apart when you look closer.

Three Reasons Today Is Different from 1999

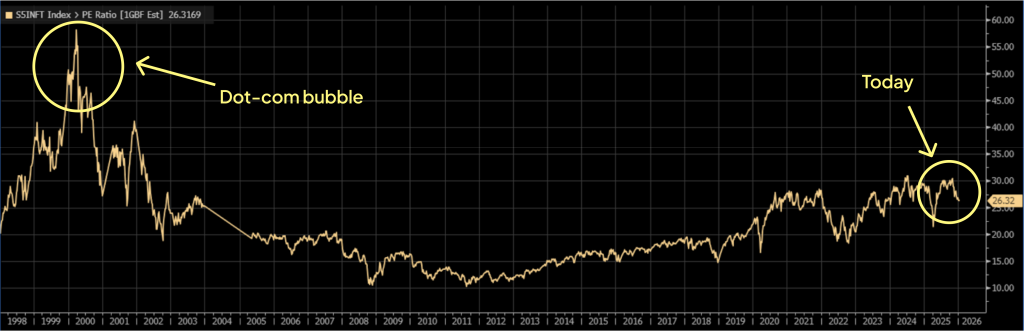

1. Tech Is Trading at Significant Discount vs. 1999

There has been significant attention on tech valuations in particular. This isnŌĆÖt a surprise, as the tech heavy ŌĆ£Mag-7ŌĆØ has dominated market performance for the last three years. However, the reality is that the largest tech companies are not trading anywhere near the nosebleed valuations reached during the dot-com mania. In 2000, the S&P 500 Technology Index was trading at nearly 60x P/E. Today, this index is trading at a much more reasonable ~26x, or nearly 60% cheaper than the prior peak.

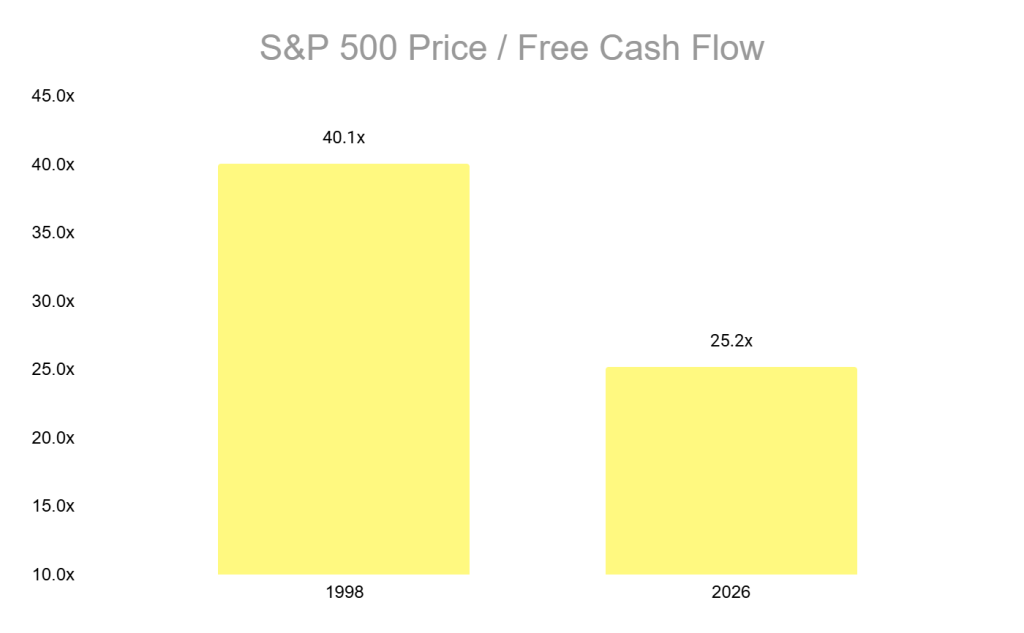

2. The Overall Index Is of Significantly Higher Quality

The composition of the S&P 500 has also fundamentally changed over the past 25+ years. In the late 1990s, many of the most ŌĆ£excitingŌĆØ companies were early-stage, cash-burning businesses with unproven modelsŌĆöparticularly across the internet/telecom complex. TodayŌĆÖs index is far more heavily weighted toward high-margin, asset-light platform businesses with fortress balance sheets and durable free-cash-flow generation.

This matters because cash flow is what ultimately pays investors. When you look at valuation on a cash flow basis, using a price-to-free-cash-flow multiple instead of P/E, the valuation story of the S&P 500 looks dramatically different. TodayŌĆÖs index is of much higher quality, and trading at a wide discount to levels reached preceding the dot-com crisis.

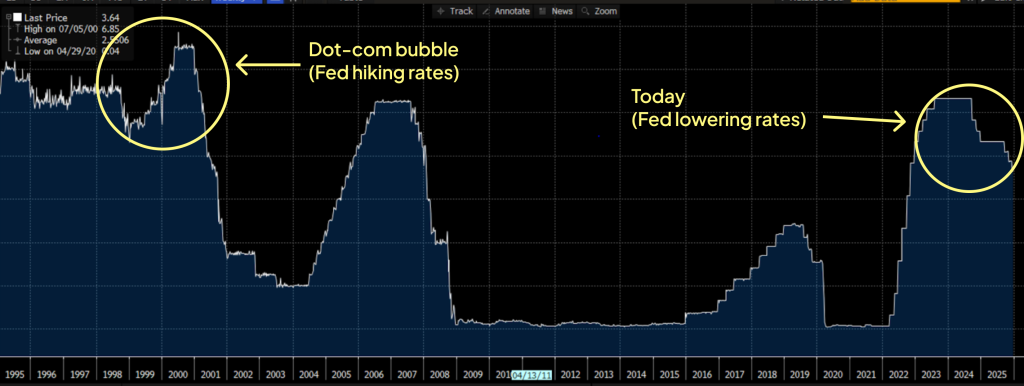

3. Different Fed Policy Dynamics

As discussed in RangeŌĆÖs outlook, the Fed is the variable that matters more than valuation. A key distinction between today and the dot-com era is that in the late 1990s, the Fed was hiking interest rates and attempting to slow down the economy and compress valuation multiples. Today, the Fed is doing the opposite. They are actively cutting rates and easing liquidity.

The Outlook for 2026 ŌĆō The Risk Is to the Upside

The market enters 2026 with an uncomfortable headline: The S&P 500 screens ŌĆ£expensiveŌĆØ on traditional P/E metrics. But the dot-com comparison is the wrong mental model. TodayŌĆÖs index is higher quality, megacap tech is not priced like 1999, andŌĆömost importantlyŌĆöthe Fed is easing rather than tightening. Taken together, thatŌĆÖs a setup where valuation can hold stable or even expand.

, many experts expect valuation multiples to generally hold steady and market performance to be earnings led. That said, there is upside risk to valuations as the ŌĆ£other 493ŌĆØ S&P 500 companiesŌĆötrading at average valuationsŌĆöhave significant room to rerate higher. Of course if we do start entering bubblelike territory, history shows that even megacap tech valuations can jump meaningfully from here.

Disclosures:

This communication contains forward-looking statements that reflect Range Advisory, LLCŌĆÖs (ŌĆ£RangeŌĆØ) current views, expectations, beliefs and/or projections about future events or results. Forward-looking statements involve risks and uncertaintiesŌĆöincluding, without limitation, market conditions, regulatory changes, economic conditionsŌĆöany of which could cause actual results to differ materially from those expressed or implied by such statements. Range undertakes no obligation to update or revise any forward-looking statements to reflect new information, future events or otherwise, except as required by law. Recipients should not place undue reliance on forward-looking statements, which are presented for informational purposes only and do not constitute investment advice or a recommendation to buy, hold, or sell any security. Past performance is not indicative of future results. The views, opinions and analyses expressed by Range in this material are those of Range as of the date shown, and are provided for informational purposes only.

was produced by and reviewed and distributed by ┬ķČ╣įŁ┤┤.