How student loan forgiveness could boost Black homeownership rates

How student loan forgiveness could boost Black homeownership rates

Six in 10 millennials who don't own a home say it's because of student loan debt, according to a 2021 survey from the.

College costs skyrocketed in the last two decades. rose nearly 31% at public universities and more than 41% at private universities, according to the Education Data Initiative. Students now pay an average of $35,551 a year.

This debt has worsened the racial homeownership gap, which has widened over decades of discriminatory lending practices, racist housing policies, and barriers to wealth for Black Americans and other people of color. These trends led higher numbers of students from marginalized communities to assume additional financial risk for a college degree.

For many, loans make college possible. More than 45 million people in 2020 , averaging $37,693 per person, per Education Data Initiative. These costs have made it difficult for many to afford a down payment on a home. The homeownership rate falls by nearly 2 percentage points for every additional $1,000 in student loan debt a borrower holds, according to the.

麻豆原创 examined data from the and the to see how federal student loan forgiveness could boost U.S. homeownership rates, particularly among Black Americans.

Because Black Americans have historically been unable to build wealth as easily as their non-Black counterparts, they're relying more on loans to obtain big-ticket items like higher education and homeownership. Higher student loan payments and interest rates hinder their ability to buy a home and can trap them in a cycle of inequality. In August 2022, the Biden administration announced it would forgive $10,000 in student loan debt, affecting about 43 million borrowers.

Keep reading to see the effect of student loan forgiveness on Black homeownership rates in the U.S.

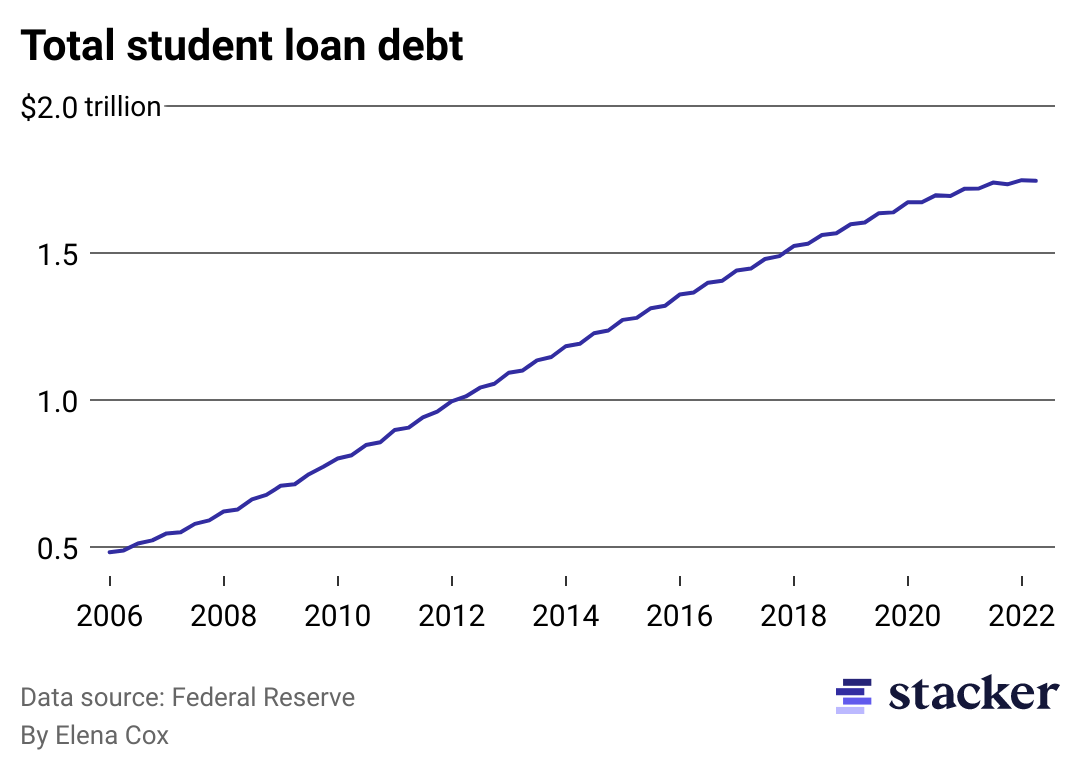

Americans hold more than $1.7 trillion in student loan debt

Student loan debt has nearly tripled since 2006.

Although total debt continues to increase, the growth rate . In 2013, the year-over-year change was 12.1%; last year, it was 0.31%.

The federal government paused federal student loan payments during the pandemic, which set interest rates at 0% and allowed borrowers to skip loan payments without the risk of late fees or default. This policy lower their balances, but it's due to expire at the end of 2022.

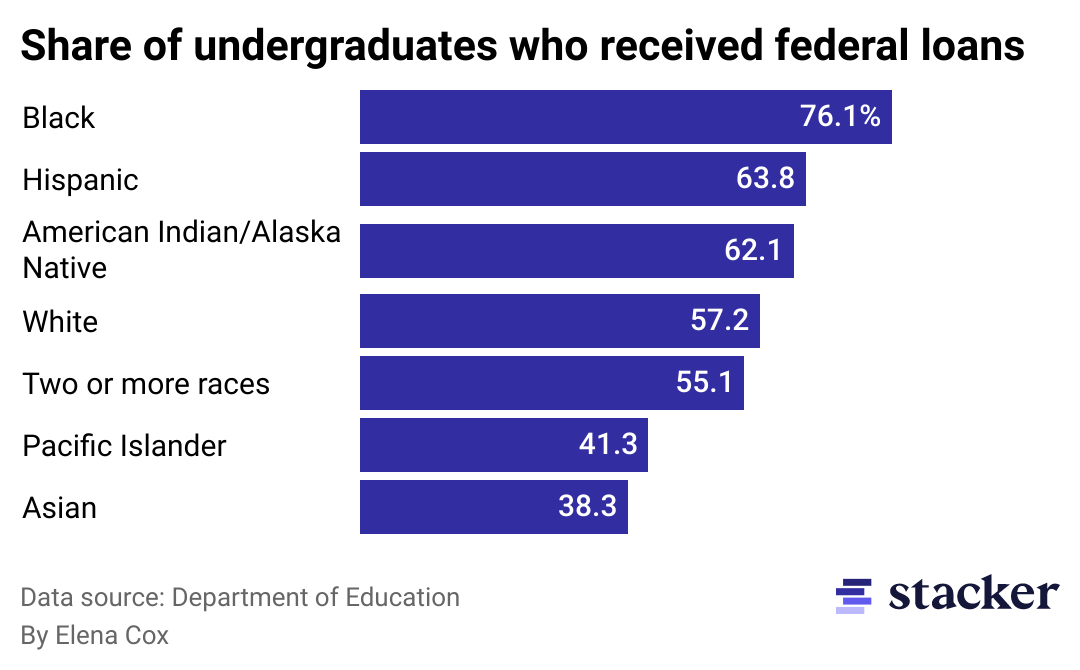

Black and Hispanic students are more likely to have student loan debt

A Brookings Institute analysis found that Black Americans face a when paying for higher education. The report found that Black American households cannot build wealth at the same rate as non-Black households. This finding also means Black students borrow more money for college and have higher loan payments upon graduation, which reduces their opportunities to build wealth during their prime earning years.

Hispanic Americans also experience a wealth gap, which fuels the need to take out more in student loans,. Many Hispanic Americans are also first-generation college students, which can make it difficult for them to navigate the financial aid system.

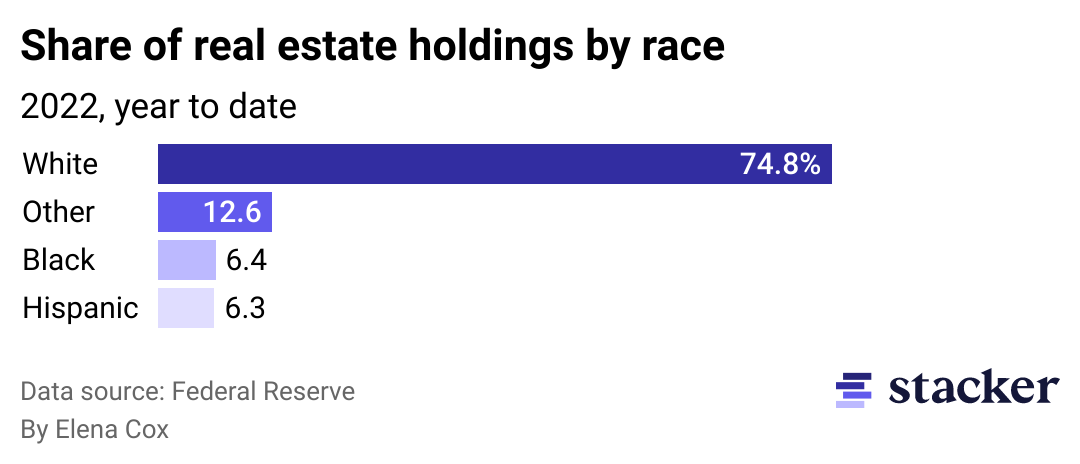

Black Americans have lower homeownership rates

The Black homeownership rate (43.4%) lags considerably behind white Americans (72.1%) and has declined by nearly 1 percentage point since 2010, according to the. In fact, that than when the was passed in 1968.

Black households also lag in earnings, making only 61 cents for every dollar that comparable white households earn, according to an analysis by the of the latest Census Bureau data. With lower earnings on average, Black Americans are denied mortgages at double the national average, according to a 2022 study.

Black Americans will often seek higher education to help increase their earning potential. Still, it's hard to take on more debt when student loan debt payments make up a significant portion of a monthly budget. Due to student loan debt, nearly .

What student loan forgiveness could mean for Black Americans

Black Americans face disparities in wealth building, and student loans have exacerbated that issue. More than half of Black American households with student loan debt have no or negative net worth, about twice as much as those with no student debt, according to a .

Student loan forgiveness would not eliminate the racial wealth gap but could significantly reduce it. Loan forgiveness may also present more opportunities for Black Americans to afford homes and build intergenerational wealth consistent with the American Dream.